- by Dr. Mike

Previously, we went through all the aspects of setting up your freelance business correctly as an LLC. Let’s now look at the money side explicitly: What should freelancers invest in to win in the ever more challenging game of global freelancing?

For career freelancers, building a successful business requires more than just talent and dedication; it demands strategic investments in essential tools, skills, and resources. As the freelance market becomes increasingly competitive, it’s crucial to differentiate yourself by not only offering high-quality services but also by running your business efficiently and professionally. The right investments can significantly enhance your productivity, help you attract and retain clients, and ensure long-term sustainability.

Key areas where freelancers should focus their investments include various topics such as ongoing training and education, branding, marketing, and up-to-date technologies. By strategically investing in certain areas, freelancers can transform their businesses from mere gigs that pay peanuts into thriving, long-term ventures, positioning themselves for sustained success in the dynamic freelance landscape.

Every business requires investments! The sooner one gets it, the faster one gets to the good money! And real business!

So, let’s do a simple countdown from the least important to the most critical targets for freelancers to invest in based on my 10 years of freelancing experience. Based on what I’ve done and what I realized later I should have done. These are the things you might want to consider on your path toward the top of the coconut tree!

Things you COULD invest in

Let’s start with four categories of tools, services, and other things you might get away from spending on. We start from the least important thing: productivity, believe it or not.

Let me explain…

7) Productivity and organization

Don’t get me wrong, productivity is super important. But as a freelancer, it’s not what you need to invest your money in at first. Or perhaps ever, depending on a couple of things.

Sure, there are things you could buy and use with a clear purpose and find things going a bit more efficiently:

- Project Management Tools: Software like Trello, Asana, or Monday.com to manage tasks and deadlines.

- Time-Tracking Software: Tools like Toggl or Harvest to track billable hours and improve time management.

- Client Relationship Management (CRM): Tools like HubSpot or Zoho to manage client communications and relationships.

- Automation Tools: Invest in tools that automate repetitive tasks, like scheduling, invoicing, or email follow-ups.

But honestly, many of these things come to you from other sources for free! For example, if you do hourly-paid work on Upwork, the only way the Payment Protection of the platform covers you is that you use their Desktop App to count the hours. Many clients use team licenses of various project management software, e.g. Trello, so you won’t need a license of your own. So, first, you might get those from other sources for free.

Second, you probably don’t need project management tools if you know project management principles from your pre-freelance career. (I personally only needed Google Calendar and Notepad. Yep, the default program since the first Windows version. Project management is something you do in your head anyway all the time!)

CRM systems are most of the time overkill for freelancers. If you work on a couple of well-paid gigs a year and your main income comes from 1-2 long-term client projects, how much would you benefit from any kind of CRM regardless of what cool features it has? Little if any.

Now, the only thing worth really considering is the business automation. Two obvious points here:

A) Invoicing: If you write manual invoices, yes, you might save some money. But you lose time. This is a good option only when you’re not busy! But for “busylancers,” manual invoicing is a productivity killer! Also, the process is prone to mistakes. I know because I made them in my first year. Currently, my banking service covers invoicing which is a really good and free option. Fantastic, I must say!

B) Scheduling: This is another potential time-sucker! Tools like Calendly are an excellent choice for scheduling and especially rescheduling your client meetings. If you can use a tool to save you from reading emails, manually navigating to your calendar, making changes, sending notifications, etc. do it!

But none of the above are critical for a small one-person business that has a limited number of clients per year. None. Therefore, productivity and organization tools are the least of your worries. Most freelancers have more time than clients anyway (and I say this based on the quite surprising results of this poll)!

6) Financial management

Sixth on the list is all the finance stuff. Why so low in this ranking, you might ask, business is all about money, isn’t it? Well, simply because all the next five categories affect your cash flow, i.e. where the money comes from!

You simply don’t need to focus on managing your money if you’re not making any! Right?

Of course, you could think it the other way around: If you must work for peanuts, every penny that lands in your bank account counts. But that’s the Peanut Way of Freelancing. You must aim higher than that, otherwise, all you will ever do is keep your freelancing as a petty small business – forever! Don’t go that way, I beg you, for your own sake.

Once you have something substantial, e.g. gigs that pay over $10,000 per week(!), then you have the luxury of optimizing everything. (Well, honestly, most are happy with a couple of thousands per week to be realistic here.) So, first, focus on your value, then on your finances. Never start by counting your peanuts and “working your way up” by saving every little penny you make!

But, in principle, you could invest in financial tools and services such as:

- Accounting Software: Tools like QuickBooks or FreshBooks to manage finances, invoices, and taxes.

- Professional Accountant: Consult an accountant for tax planning and financial advice.

- Business Bank Account: Separate bank account for business income and expenses to maintain clear financial records.

- Insurance: Business insurance, liability insurance, and health insurance to protect your business and personal well-being.

- Emergency Fund: Set aside savings for slow periods or unexpected expenses.

These are all good ideas, but not as important as the categories that come next. Well, of course, you should have some kind of personal insurance, perhaps business insurance too, and having a professional who takes care of your taxes might not be a bad move at all.

But most of these things aren’t that big a thing to figure out as you’ve probably got some experience in them from your past life. The most critical things in this category are probably A) the emergency fund and B) separate bank accounts for personal and business transactions. The first one is for rainy days that everyone will have to endure at some point, and the second one is for simplifying your books. This one will save a lot of time and headaches!

5) Tools and technology

Next comes the tech part, such as:

- High-Quality Computer: A reliable and fast computer to handle work efficiently.

- Software Subscriptions: Invest in essential software like Adobe Creative Suite, Microsoft Office, or industry-specific tools.

- Backup Solutions: Cloud storage and external hard drives for secure data backup.

- High-Speed Internet: A stable and fast internet connection to ensure smooth communication and productivity.

- Ergonomic Workspace: Comfortable chair, desk, and accessories like an external keyboard, mouse, and monitor to prevent strain.

Of this list, I’d highlight the backup solutions (I’ve been using the paid version of Dropbox since I have no idea when). It’s a lifesaver that guarantees that you don’t spend time redoing any work because you accidentally deleted some files.

But again, the rest on the list, are things that can help you really boost your freelancing, but not having any of them is hardly a showstopper. Probably half of the 20,000 freelancers in my LinkedIn network don’t have a perfect infra in their country or at home. Slow internet, a basic laptop, free versions of professional tools, cheap monitor, unergonomic chairs… Having high-end things falls into the “nice-to-have” category of things that you get to focus on only when the more important things have been taken care of.

4) Sales tools, marketing, and branding

Marketing, branding, sales… now we’re getting into the core of your business: How to find clients in a way that you never run out of them? And only those clients that pay you well.

This should be obvious to all. If you don’t find an efficient way to get clients… well, that’s when most freelancers go back to their day jobs if they still can. The income just isn’t enough to live on it.

The following relates to the ‘sales channels’ that I wrote about earlier. There’s much more to freelancing than creating an Upwork or Fiverr profile, listing some skills and gigs, and waiting for money to rain on you. This is where you might want to put your money… and literally every item might cost you solid cash:

- Professional Website: A well-designed portfolio website showcasing work, services, and client testimonials. Alternatively, a professionally made profile page on a freelance marketplace like Upwork.

- Domain Name and Hosting: Custom domain name and reliable hosting services to establish an online presence.

- SEO and Digital Marketing Tools: Tools like Google Analytics, SEO plugins, and email marketing platforms to reach a broader audience.

- Branding Materials: Business cards, logo design, and branded templates for documents and presentations, e.g. portfolio decks and contracts.

- Social Media Presence: Consistent branding across professional social media platforms like LinkedIn, X, and Instagram.

- Marketplace fees such as commission percentages and Upwork Connects.

Unless you’re doing offline freelancing for people living next to you, you need some kind of online presence to impress potential clients. Otherwise, no clients! 😉

None of the options are free. Even if you specialize in designing branding materials for others, would you be able to execute branding as a process for yourself? Even if you specialize in social media management, would you really know how to use any of the platforms to bring you clients efficiently?

For almost everything presented above, you’d need to pay for a service of some kind. Or spend years learning the basics of social media marketing and branding through trial and error and go D.I.Y. like The CocoLord! Your choice, of course. Professional services rendered by freelancers who specialize in things that you know nothing of are worth the money every single time.

I don’t know a single good freelancer who doesn’t pay anything for any of these subcategories. Annual web hosting fees might be the minimum for almost every freelancer.

Things you MUST invest in

Now we’re closing the critical bits. Whereas you could, at least in theory, survive some kind of freelance business without spending anything on the first four categories, the Top 3 are mandatory: First, legal compliance with every regulation that applies to your type of business in your country. Second, personal well-being. Third and last, and most importantly, your skills.

3) Legal and compliance

Let’s quickly look at the legalities:

- Business Registration: Invest in registering your business as a sole proprietorship, Limited Liability Company (LLC), or corporation, depending on your needs.

- Compliance: Tools or services that ensure your business complies with local, state, and federal regulations, e.g. business license.

- Contracts and Legal Templates: Invest in professional contracts, NDAs, and other legal documents to protect your work.

- Legal Consultation: Seek advice from a lawyer for business structure, contracts, and intellectual property rights.

If you’re destined to go solo for a longer period than a couple of years, setting up a formal business name as a separate legal entity is probably the best move. This we discussed in the previous article: My recommendation is to form an LLC because of all the perks you get in the long run.

Business licenses and other requirements imposed on you by law you cannot escape. And none of them are free.

For complicated big projects, you might need your freelancer lawyer friend to draft you a legally binding contract to make sure you get paid on time and in full. He or she won’t probably do it for free.

The least urgent might be legal consultations if you keep your business simple, work mainly through freelance marketplaces that have these in place for you, and so on.

Anyway, you cannot avoid paying to stay compliant and run your business free of the risk of getting fined or even jailed for running an illegal operation.

2) Personal well-being

Now, the second-most important thing: You as a living and breathing human being. Let’s consider the following briefly:

- Health: Invest in physical health through gym memberships, wellness apps, and healthy nutrition.

- Wellness: Healthy habits to maintain mental health, peer support, or therapy by mental health professionals.

- Work-Life Balance: Tools or services that help balance work with personal life, like scheduling apps, or time management and project management courses.

This should be simple. If you cannot stay healthy, could you run your business from a sickbed?

And if your work takes up all your time and you still only get paid peanuts, how long could you freelance realistically if your chase for money tests your sanity every single day? And no breaks, no holidays, moreover!

Of course, you need to take care of yourself. A one-person operation doesn’t run if that person isn’t physically healthy enough to do everything the business needs to make happen. Nor will it run properly for years if your mind isn’t in its right place which prohibits you from getting stuff done.

So, Number 2 is your well-being. You have to get to a comfortable level soon even if your beginning is hard (like mine).

1) Skills and education

Whereas we all get sick sometimes, go a little crazy occasionally, and have ups and downs in the well-being side of things, we simply cannot get even started as freelancers if we don’t have skills. Skills that our clients don’t possess. Skills that took years to acquire, and even more years to hone to perfection. Skills that our clients don’t want to invest in developing for their businesses but make their businesses better.

The most important thing you must invest in is what you can do better than most others: your overall expertise. It defines the core of your business!

There are two sides to this.

A) Your core skills: These are what you use to create something for your clients that they are happy to pay for. It consists of:

- Formal Education: Your degrees and practical skills you learned in school and university.

- Ongoing Training: Courses, workshops, and certifications to keep skills current and competitive.

- Books and Resources: Industry-related books, podcasts, and blogs to stay updated on trends.

The beauty of freelancing is that initially, you only need to be really good at one skill! Any skill, actually! And it’s not mandatory to be something you studied in school and got a degree in. I know plenty of good freelancers who sell services that have nothing to do with their formal education.

However, if you have an excellent education, demanding certifications, and the ability to put them into use as the core skills for your business, you can build a flourishing career as a top-notch freelancer from the first year onward. Do this on the premier freelance marketplaces and you create a legendary track record that shows to every potential client everywhere in the world!

Some super good freelance contracts require a certain certificate. Something you only get from a course that doesn’t cost just peanuts. Just saying. Taking that course and earning that professional certification would be an investment that most others might not make!

B) Your freelancing skills: These are the business skills that allow your clients to find you, get you into interviews, and get contracts signed. My suggestion is to invest in these skills first before you go into “just trying” a little. That “trying” process might turn into a little nightmare as you cannot land gigs consistently or you fail to earn income even with superior core skills compared to your competitors.

What you could spend money strategically on includes:

- Mentorship or Coaching: Invest in a business coach or mentor to guide business growth.

- Networking Events and Conferences: Attend industry events, webinars, and conferences for learning and networking.

The coach would help you to get started on the right path without wasting time on trial and error which in its worst form is a process that gives you no feedback, no guidance on what you’re doing right and what goes all wrong. The difference is often seen during the first year of freelancing: It could be worth tens of thousands of dollars!

I tell you a little secret: Good freelancers don’t actually work alone! They team up, share referrals, hire younger freelancers as subcontractors, and so on. You may not even need to network directly with your potential clients to see a positive business impact from networking!

Do networking from your first week onward. The best networking opportunities come (in my experience) from social media such as LinkedIn and industry events that are nowhere near free (or even affordable). Networking and exclusive community events that people pay to participate in create a mutual expectation of doing business together. They can easily pay off!

The best one in my books was a professional community with an individual membership fee of about $500 per annum. It helped me to nail a 1-year coconut-sweet part-time gig that brought me over $50,000 in consecutive contracts! Anyone can count how big a percentage of my revenue the membership fee was. Absolutely worth the money!

What should freelancers invest in, honestly?

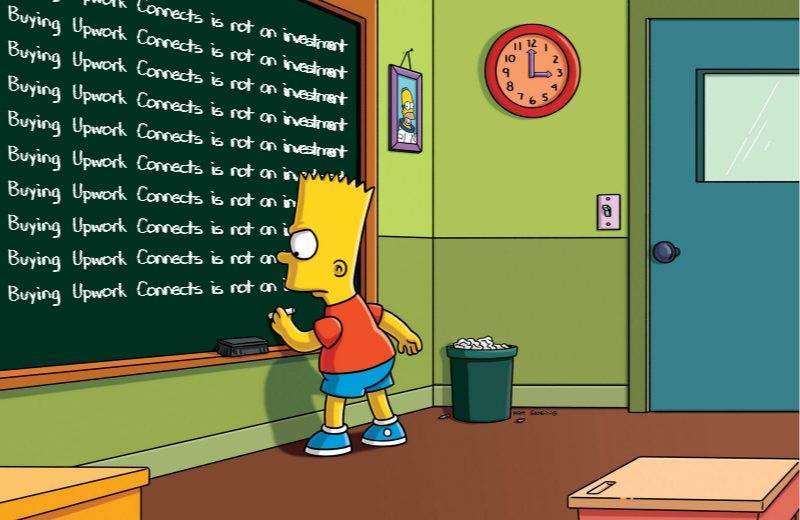

Now, let’s be honest. The above are not really investments. None of them are in the proper sense of the word. Let’s not get confused here. Just like buying Upwork Connects is not an investment like many freelancers falsely seem to think.

Repeat after me: “Buying Upwork Connects is not an investment!”

If we take the term ‘investment’ seriously like “normal” people, freelancers are not any different from others. Not at all. Normal investment rules, tactics, and strategies apply to everybody. In the above, perhaps education comes closest to a true investment even if someone else paid for your degree in the form of taxes, for example.

Investing in assets is a common practice, but it’s important to understand the nature of these investments. For freelancers, a typical asset might be a laptop as mentioned above. While you can technically resell the laptop you’ve used, it’s not a particularly strong investment unless you manage to sell it for more than you paid—a scenario that’s highly unlikely.

In this context, a laptop is better understood as a utility investment, similar to how a harvester is essential for a farmer. It facilitates your work, making it more efficient and, in some cases, even possible in the first place. But no farmer could sell a harvester that has been used for two years at a higher price than what it was first bought at.

Now… are coconuts good assets you should aim to own?

To navigate the complexities of investments, it’s crucial to grasp two key concepts: depreciation and appreciation. Depreciation refers to the decline in value of an asset over time, while appreciation is the increase in value. Various factors influence these changes, just as inflation affects the real value of your savings when compared to the interest earned.

For freelancers, most business purchases, including software and platform subscriptions or those (nasty) Upwork Connects, fall under the category of Customer Acquisition Costs (CAC) which is just one of the expense categories of an ordinary business. These are necessary expenses, but they should be understood as costs and expenses, not investments that will grow in value over time. Understanding these fundamentals is essential for making informed decisions and managing your business effectively.

So, if we summarize everything in the seven categories we went through in their correct terms, I can only conclude the following: While there are plenty of things that I can advise you to spend your money on, I could, should, and therefore, would never give you any investment advice. What is a good investment for you completely depends on where you live, what options you have, what your life situation is, how close to or far from retirement age you are, what the economy of your country of residence is, etc.

There are hundreds and thousands of factors!

Spend wisely on things that help boost your freelancing. For that, the above seven categories might give you really good ideas. Make money, then invest using the traditional investment logic in stocks, real estate, currencies… whatever is feasible and reasonable in your situation. All I can say is that everyone, even a freelancer, should invest in something!

If all of this sounds new to you, Investopedia could be a nice resource to have a look at. You learn the terminology that you can use correctly (unlike what I intentionally did in this article!) and get useful news that might help you make a choice about what you should invest your extra money in.

I hope this clarifies a bit.

Let’s conclude with a really short story. I was chatting with a wannabe freelancer who asked about something silly about freelancing which led to this exchange of thoughts (as I roughly remember it):

CocoLord: “So, what’s your biggest expense at the moment and how much have you budgeted for it?”

Wannabe Freelancer: “Man, I’m just freelancing. It has nothing to do with expenses and budgets!”

This discussion didn’t get very far, I felt like I was talking to a wall here. 🙂

After about a year, I checked back on him to see how that guy was doing. Guess if he was still “just freelancing”? No, he got a petty day job with a lower title than what he had prior to freelancing. He didn’t even “invest” his time in learning the absolute basics!

Well, this is all for now, go make more money by spending wisely and strategically on things that boost your business! Then, find some sweet targets for your true investments to make that money grow!

Dr. Mike

Mikko J. Rissanen, Ph.D., a.k.a. Dr. Mike, is an accomplished solopreneur living in a tropical paradise, inventing cool tech and coding from his beach office... and eating coconuts all day, every day. He has been running his one-man show in Penang, Malaysia, since 2014 until he moved the business to the United States as I2 Network in 2021. He is one of the most highly paid freelancers on Upwork and he has been supporting hundreds of starting freelancers since 2017. Follow his latest tips on LinkedIn or seek his personal guidance as a CoachLancer member!